The journey to becoming a doctor is often accompanied by an unwelcome partner: debt. After years of intensive study and training, many medical professionals find themselves facing considerable financial burdens. One tactic to reduce interest on debt, and also makes things simpler, is debt consolidation. This post explores how to execute a successful debt consolidation and the steps involved.

Understanding Debt Consolidation:

Debt consolidation is basically about combining multiple debts into one, easier-to-handle loan. The aim is to simplify repayment and lighten the load.

Different Methods of Debt Consolidation

There are several paths a doctor can take for consolidating debt: A fixed-rate debt consolidation loan: This involves taking out a new loan that combines all your existing debts into a single loan with a fixed interest rate. This means that the interest rate stays the same throughout the life of the loan, offering predictability and stability in monthly payments.

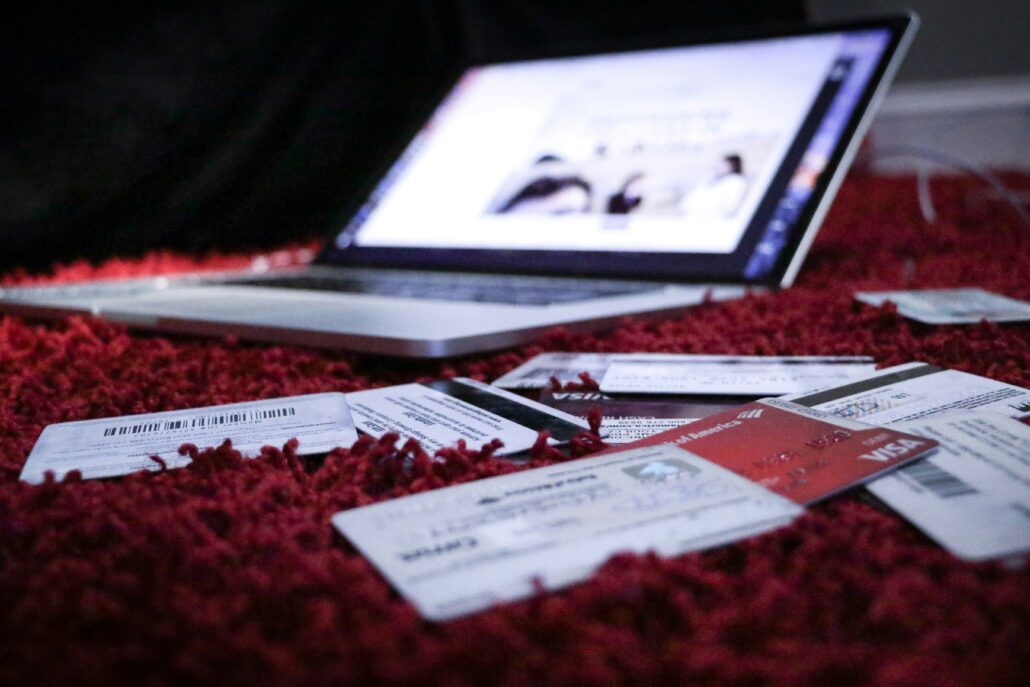

Transferring various balances to a single low-interest credit card: This is an attractive option, as the promotional period for these cards typically offers reduced or no interest, allowing substantial savings on interest payments. Utilizing a home equity loan or line of credit: A home equity loan provides a lump sum that can be used to pay off various debts, while a home equity line of credit offers a revolving credit line for continuous borrowing. Both are typically at lower interest rates since they are secured against the value of your home.

When Should Doctors Consider Debt Consolidation?

Before jumping into debt consolidation, physicians should carefully assess their financial situation. Factors to consider are the sum of your current debts, the interest rates you’re grappling with, and your credit score, which can affect consolidation terms.

Signs Pointing Toward Consolidation:

Juggling multiple high-interest debts: This can include credit card balances, student loans, and personal loans. Managing and prioritizing these debts can be overwhelming, requiring careful budgeting and financial planning to regain control of your finances. Struggling to meet monthly payments: If you find yourself frequently straining to cover monthly payments or missing payments altogether, it could be a strong indicator that your debt is becoming unmanageable. Debt consolidation might offer a more manageable monthly payment by streamlining all your debts into one, potentially with a lower interest rate, thus allowing for more financial breathing room and a clear path to becoming debt-free. Desire for a simplified financial strategy: When the complexity of managing numerous debts with varied interest rates and due dates becomes too taxing, consolidating into a single loan with a uniform interest rate can greatly simplify personal finances.

Benefits of Debt Consolidation for Doctors

Debt consolidation can be a game-changer for doctors in the financial realm.

Lower Interest Rates and Monthly Payments

By getting a consolidation loan with a lower interest rate, doctors can cut down their monthly expenses and save money in the long run.

Simplified and Manageable Repayment Plan

Consolidation can transform chaotic financial management into a simple monthly routine, giving you more mental space and lightening the administrative load.

Potential Improvement in Credit Score

Making consistent payments on a consolidated loan can reflect positively on credit reports, potentially boosting credit scores.

Risks and Considerations

However, there are potential downsides to debt consolidation that doctors need to weigh.

Impact on Credit Score

Applying for a consolidation loan may involve hard inquiries that can temporarily dent credit scores.

Potential Fees and Costs

Watch for hidden fees, such as balance transfer fees, or penalties for early repayment which could offset the benefits of consolidation.

Long-term Financial Implications

If not managed well, there’s a risk of landing back into debt, particularly if one continues to use previously maxed-out credit lines.

Conclusion

Debt consolidation can provide financial relief for physicians, but it requires soul-searching, planning, and financial discipline. By understanding the process, weighing the pros and cons, and exploring alternatives, doctors can make informed choices for their financial well-being. It’s not just a lifeline, but a stepping stone to financial freedom for medical professionals navigating uncertain financial waters.